I recently had a conversation with a marketing member of one OEM. We were in agreement that many of us did not see a continuation of low activity for this long. We asked ourselves, "What happened in the last 18 months to cause the continuing excess of heavy helicopter inventory?" Our past reasoning was that oil prices would return as demand would surely increase. In an article published in Forbes on August 28, 2016, Jude Clemente argues that world oil demand will continue to increase. It has steadily increased even through the 2008 recession. So what did we miss?

The Decline of OPECs Pricing Influence

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

In an article from Fuel Fix, a subsidiary publication of the Houston Chronicle, dated March 2016, Jennifer Hiller points out that the US dependence on foreign oil has declined dramatically. We import about 25% (this figure changes depending on definition and point of view), the lowest point since 1970. We were still importing over 50% until 2011. America’s demand for oil peaked in 2005 at a daily rate of 20,500,000 bbls. We are now using 19,000,000 bbls of oil daily. Most of the EU countries are showing the same trend of peaking some time ago and are now showing lower levels of daily demand. Regardless, that is still a considerable level of petroleum product usage.

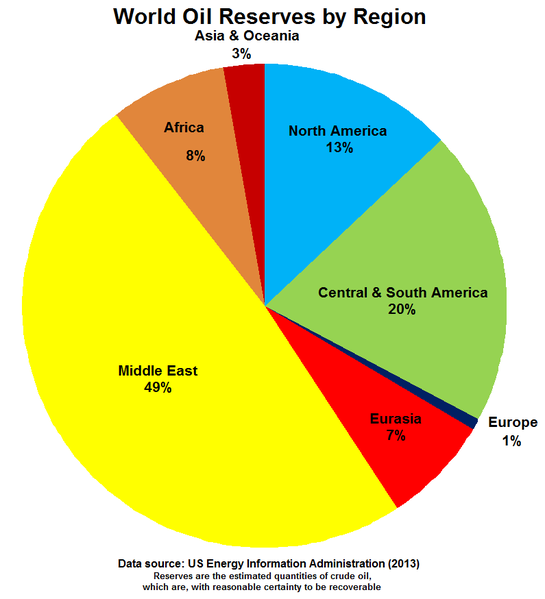

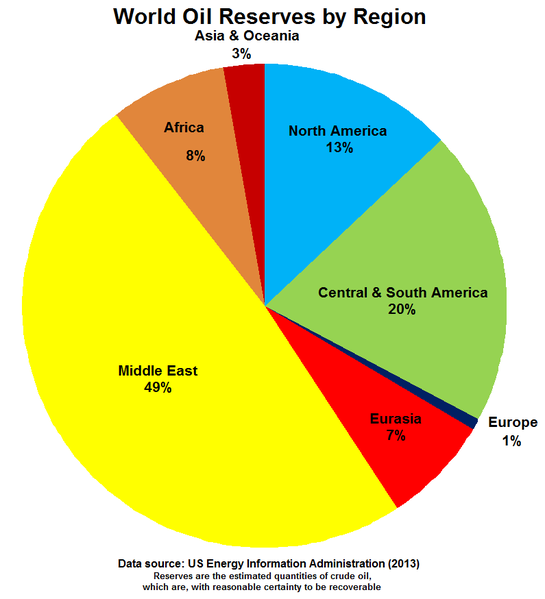

Overall demand for oil will, and has, gone up so why are prices staying at the $50-$52 per barrel range? One influence affecting where pricing sits today is the many sources of cheap-to-recover oil. In 1973, the eleven nation Organization of the Petroleum Exporting Countries (OPEC) shook the world by placing an oil embargo on the countries in the West who supported Israel. The members of OPEC, with the exception of Venezuela, were Islamic nations. Solidarity was never a question. OPEC had almost ⅔ of the then-estimated raw petroleum reserves of the World. Forty years later in 2013, estimated reserves had gone down to 49% as shown in the chart.

Overall demand for oil will, and has, gone up so why are prices staying at the $50-$52 per barrel range? One influence affecting where pricing sits today is the many sources of cheap-to-recover oil. In 1973, the eleven nation Organization of the Petroleum Exporting Countries (OPEC) shook the world by placing an oil embargo on the countries in the West who supported Israel. The members of OPEC, with the exception of Venezuela, were Islamic nations. Solidarity was never a question. OPEC had almost ⅔ of the then-estimated raw petroleum reserves of the World. Forty years later in 2013, estimated reserves had gone down to 49% as shown in the chart.

There are 13 member nations now, and relations between the member nations are very shaky. Indonesia dropped out last year in disagreement with the “core” members. There are 117 countries producing oil today. Out of the top 25 oil producing countries, 16 are non-OPEC member nations.

Where are the largest reserves today? Well, it depends on who is reporting the data and what definition of “proven reserves” is being used. There is no doubt that OPEC sits on a significant portion of the World’s oil. North America has surpassed Saudi Arabia, Russia, and Venezuela in estimated reserves. Estimates of China’s reserves seem to go up every year. Russia certainly has a significant amount of oil reserves. A majority of world reserves are now outside OPEC.

Exploitation of Shale Oil Reserves

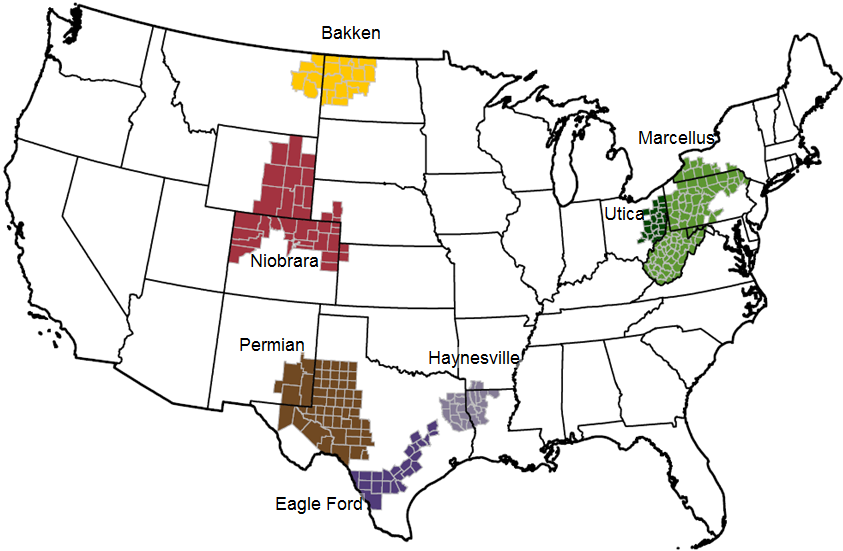

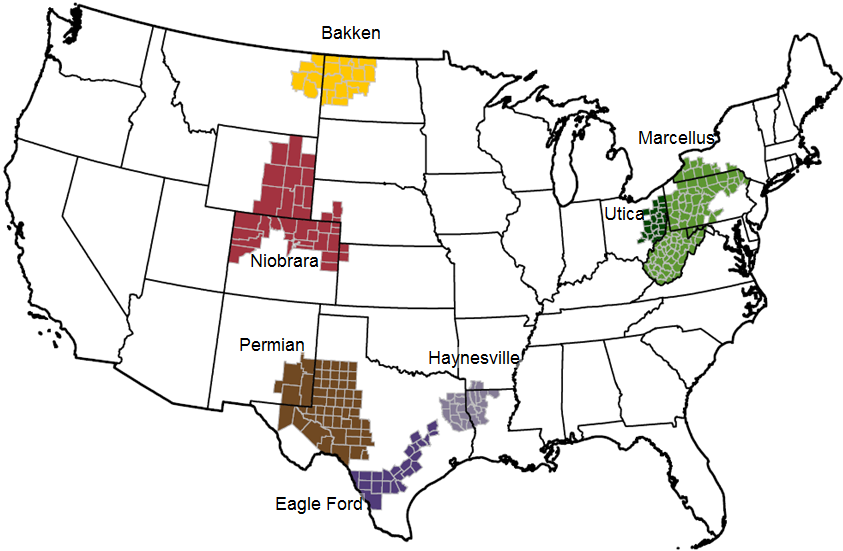

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

It continues to get cheaper each year. For instance, when the price of oil got to $56 a barrel, many owners of fracked oil wells turned on the spigots, and US demand for imported crude oil dropped. The price for a barrel of crude dropped to $50 and has “recovered” to $51. Oil recovered from “fracking” is termed “tight oil.” Tight oil comes out of the ground cleaner meaning it is cheaper to refine into usable petroleum products than Brent Crude or May West Texas Crude (heretofore, the cleanest recovered oils). Despite the low price of oil, rig counts in the US are increasing.

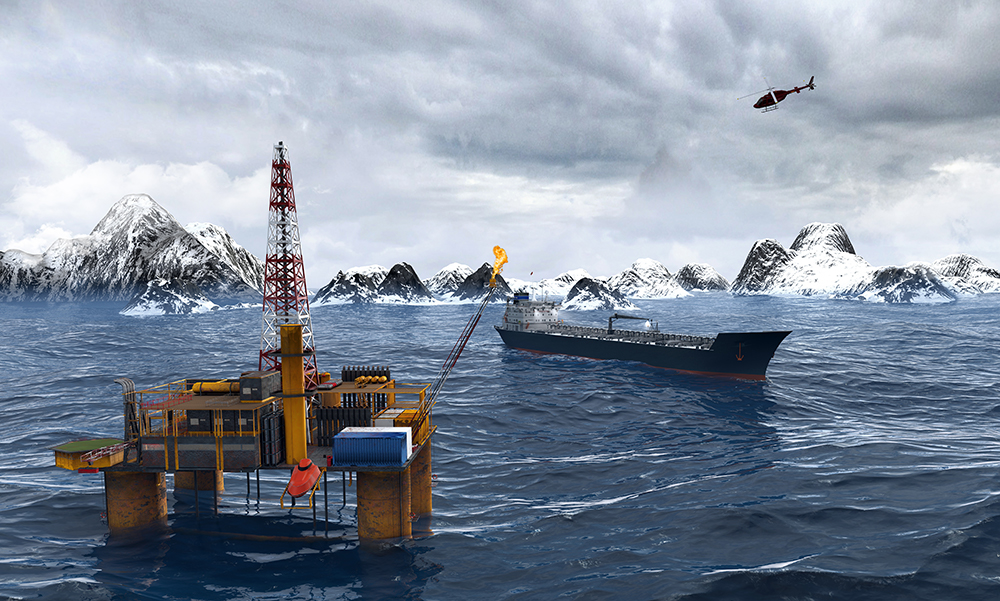

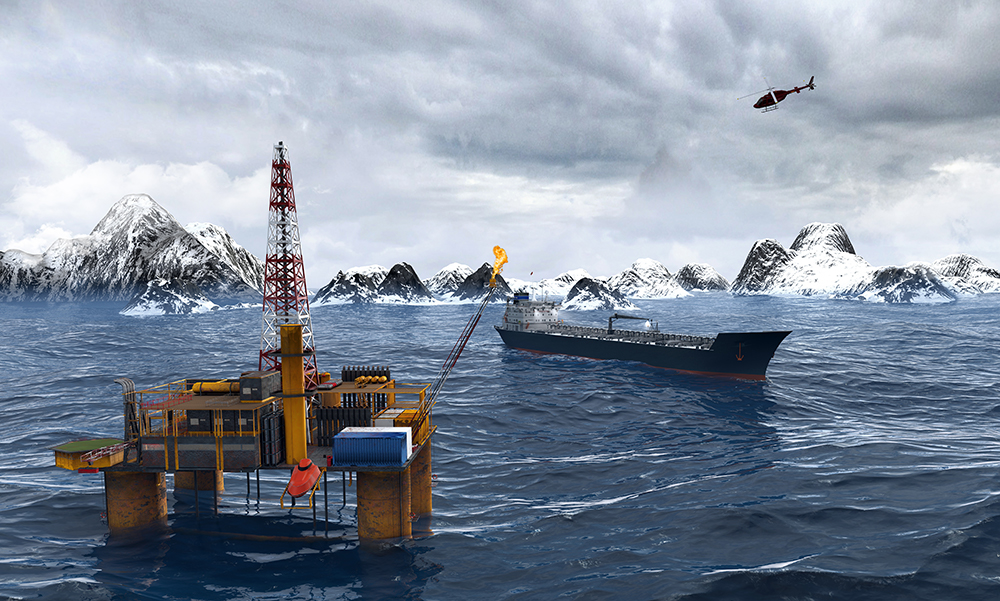

The North Sea reserves are located far offshore and in deep water. Weather rapidly changes and can be very severe. It increases the cost to discover oil and then to recover oil. The Brazilian and Angola reserves are the next highest cost to recover because their reserves lay offshore under a sometimes two-kilometer thick “Presalt” layer. It is true that those costs have gone down as technology and techniques have improved, but any “deep water” exploration and recovery carries a higher cost than shallow water and land recovery oil wells.

The Effect on the Used Sikorsky S-92A Market

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

Because of the distance required to fly to any oil well, the S-92A is used almost exclusively in the North Sea, to a lesser extent the Brazilian Atlantic and the Gulf of Mexico. The older S-92A values are suffering from, well, age. Many of the new contracts in the North Sea will call for newer S-92As because of the requirements of oil companies and/or unions. Renewed production of the S-92A will face stiff competition because some of the contract renewals are asking for mediums and super mediums rather than the S-92A for cost savings. As a consequence, we see some used S-92A’s being returned to the banks at the end of their contracts. With virtually no secondary market for this aircraft, there has been little interest in what is coming onto the market. The trend of decreased values will likely continue until oil prices recover to a level that is profitable in the North Sea or the values of the S-92A reach a level that competes with the Super Mediums.

Oil prices may not have to recover as much as some fear to bring more activity to the North Sea. The big players (ExxonMobile, Shell, BP, Talisman, Hess) need a large profit margin to explore and operate. The smaller players, for example, Wintershall, Delek, and Chyrsaor, do not need a large exploration budget and they are willing to work on a smaller profit margin. They don’t look for oil. They exploit “spent” oil tracts. They don’t need the per barrel price for oil to be as high as the “large” oil companies. Wintershall’s Maria field was drilled the first time in the 1980s by Statoil. Wintershall acquired the rights recently and by combining pipelines and consolidating oil rigs, plan to continue to extract oil profitably. This is the possible future for “played out” oil fields throughout the North Sea. So, about $55-$60 a barrel could bring a return of some new contracts. The Maria field is about 200kms off the Norwegian Coast. Older helicopters would not be a problem as these operators need a tighter margin (read cheaper helicopter rates) to be profitable.

Technological advances will continue to drive down drilling cost on and offshore. As the world settles into the shift of sustained low ppb oil, the adaptive S-92A helicopter market will eventually find it's place in this new era.

About Ben Moore, ASA - Mr. Moore is a staff appraiser with HeliValue$, Inc. He specializes in helicopter parts inventories, legacy, Russian made, and military helicopters. He was a part-time onsite verification representative of HeliValue$, Inc. from 1984 to 2007. He developed the appraisal programs for inventories, the S64 “Aircrane”, the Russian helicopters MI-8 & KA-32-117, the UH-60 and the CH-47D. He is also a part-time Line Pilot in Command for Helicopter Transport Services, Inc.

As an Instructor Pilot, Mr. Moore has accumulated over 8,000 flight hours of instruction. He has given instruction to Vietnamese, Iranian, Ecuadorian, Peruvian and Canadian pilots in both flight and ground instruction. He has taught flight and ground training to Ecuadorian and Peruvian Pilots in Spanish. He teaches a full transition course for both the S-58 and the S-61 helicopters.

About HeliValue$, Inc. - Continuously published since 1979, The Official Helicopter Blue Book® is the only blue book in the world devoted entirely to helicopters. HeliValue$ is Most Trusted World Wide®in the helicopter industry for resale pricing, technical specifications, and maintenance costs. Their only business is helicopter values: the subscription sales of their publications, their desktop appraisals, onsite asset verification, technical and operational analyses, residual projections, and related reports concerning the values of more than 200 different commercial models and their components.

Login

Login

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years.

America continues to be the largest consumer of petroleum products with the European Union close behind. China is third but has the fastest growing demand. The United States consumes about 19,400,000 barrels of oil daily, the EU is at about 18,000,000, and China is at about 12,000,000.Everyone else is far behind, but next is India at about 4,200,000. India has the second largest population in the world with an estimated 358,000,000 under the age of 15. Mr. Clemente says this is the biggest reason that India’s economy and thus petroleum product use will continue to rise rapidly in the coming years. Overall demand for oil will, and has, gone up so why are prices staying at the $50-$52 per barrel range? One influence affecting where pricing sits today is the many sources of cheap-to-recover oil. In 1973, the eleven nation Organization of the Petroleum Exporting Countries (OPEC) shook the world by placing an oil embargo on the countries in the West who supported Israel. The members of OPEC, with the exception of Venezuela, were Islamic nations. Solidarity was never a question. OPEC had almost ⅔ of the then-estimated raw petroleum reserves of the World. Forty years later in 2013, estimated reserves had gone down to 49% as shown in the chart.

Overall demand for oil will, and has, gone up so why are prices staying at the $50-$52 per barrel range? One influence affecting where pricing sits today is the many sources of cheap-to-recover oil. In 1973, the eleven nation Organization of the Petroleum Exporting Countries (OPEC) shook the world by placing an oil embargo on the countries in the West who supported Israel. The members of OPEC, with the exception of Venezuela, were Islamic nations. Solidarity was never a question. OPEC had almost ⅔ of the then-estimated raw petroleum reserves of the World. Forty years later in 2013, estimated reserves had gone down to 49% as shown in the chart. The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade.

The main reason that North America now has such large reserves is the viability of oil recovered by hydraulic fracturing. It was once thought that the price per barrel of oil had to be about $100 to make oil recovered by “fracking” economically viable. That was in 2011. The technology and techniques have improved every year. Oil prices had to be at $70 for fracking to be economical in 2014. In 2016 U.S. Energy Information Administration (EIA) commissioned HIS Global Inc. (HIS) to perform a study of upstream drilling and production costs. The report found that average well drilling and completion costs last year had fallen 25 to 30 percent below 2012 prices – the high point of the last decade. There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.

There were significant changes to helicopter values during our March 31, 2017, pricing meeting. The aircraft that had the most significant movement was the Sikorsky S-92 A. This is mostly due to the paucity of contracts in the North Sea. Obviously, the plunge in world oil prices in 2014 and the continuing low pricing per barrel of oil are the main reasons for the low helicopter activity. Another factor is the introduction of the “Super Medium” H175 and the AW189 in an already saturated market. The cost savings of leasing, buying, and operating the H175 or AW189 is giving them an edge compared over other heavies. There has also been an increased use of AW-139s where they can be employed over other aircraft. Regardless, any way you look at it, contract activity is very low and some available contracts are now requiring alternatives to the S-92A.